By Margaret Kamba

International Monetary Fund IMF officials were this Wednesday schooled on how the ZANU PF led government has stood the test of time and survived.

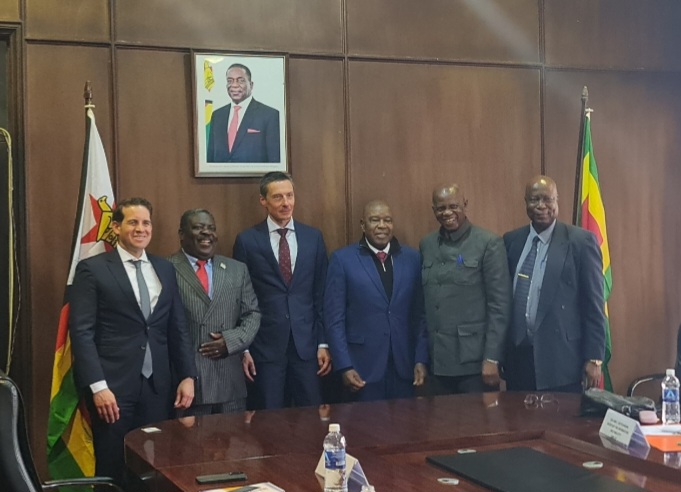

IMF Mission Chief for Zimbabwe Mr Wojciech Maliszewski and IMF Resident Representative Mr Carlos Caceres visited the ZANU PF Headquarters as part of their consultations and were met by ZANU PF Politburo members Secretary for Economic Affairs: Cde Rugeje, Secretary for Information and Publicity: Ambassador Christopher Mutsvangwa and Secretary for Legal Affairs: Cde Patrick Chinamasa as well as Party Directors.

Sharing their observations, Mr Maliszewski admitted that "There has been tremendous progress on the local currency ZIG, and its a big achievement. Make sure that what is working keeps working."

Ambassador Mutsvangwa shared that the West has always wanted ZANU PF out of power in order to advance its interests but has failed.

"The perception of the private sector has been Western and the behavior backing the colonial era. There was an anomaly in the currency being managed by the private sector, and sadly, there was no flagging by the IMF.

Cde Mutsvangwa said in 2008 when the depreciation of the local currency could have been measured by the velocity of any transaction, the Government approached China Tobacco as an avenue to finance the local farmers and this saw the steady recovery.

Cde. Ambassador Mutsvangwa further pointed out on how a selectively groomed stock trading derivative on the ZSE usurped the role of national currency.

This stock derivative was discriminately accorded exclusive fungibility through listing in multiple exchanges.

The central RBZ bank backed this exclusivity by according primacy of foreign exchange settlement to the fungible derivative.

De facto, the derivative was egrigiously awarded attribute of sole hard currency.

Bad money chases good money. The sluice gates of horrendous hyperinflation were opened.

The President 'killed' this nefarious conduct by suspending the trading of the 'chosen' stock derivative on the local bourse.

Revealingly, it has steadfastly avoided migrating to the newly set up Victoria Falls Stock Exchange that deals strictly in hard currency.

The reason being the model will be shorn of monopolised fungibility adornment.

There was also the contrived or uninformed lapse in regulation in the advency of digital money from the nation's largest mobile network operator.

In yet another egrigious conduct, foreign currency trading was abused through an un-secured and eponymous market.

The President's hand was forced. He husbanded the private mobile digital money into central RBZ regulation through its ZimSwitch.

These interventions are highlights of a slew of Presidential interventions that have restored a measure of currency management.

They paved the highway to the gold backed ZiG. We owe its rise to the enterprising hard working and business spirit of SME gold producers, SME golden leaf tobacco farmers. Noteworthy also are diaspora remittances which seamlessly coalesce our domestic economy into global markets.

He said the interventions by His Excellency, President Emmerson Dambudzo Mnangagwa saw to the positive change.

It was not from the IMF, and it was not from the currency which you want to advocate for, the USD but gold which is the oldest currency of the world. Why is the private sector not interested in financing the new players?"

Cde Mutsvangwa lamented that the funds that have been earned by the young men and women digging gold are the ones that the world wants to now manage.

"Zimbabwe needs investment as it has borne the tremendous burden to support the international community without the reciprocal support."

Cde Chinamasa said, "We have had a sanctioned economy but have done exceedingly well. We have survived and the economy has unleashed the potential amongst our people."

Cde Rugeje commended the IMF for "expressing confidence in the ZIG. ZANU PF will always come up with policies to ensure that all stakeholders emphasize the supremacy of the Party over Government."